A new tool for financing biodiversity conservation

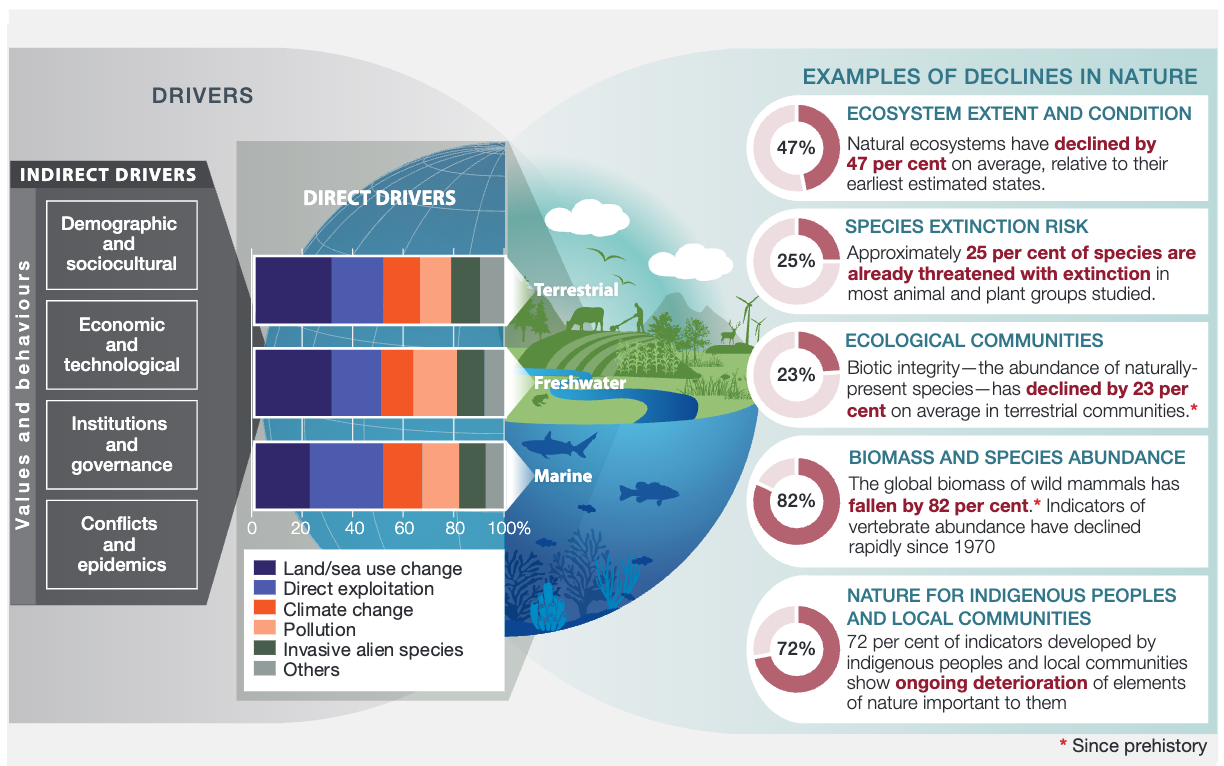

Direct and indirect drivers of biodiversity loss. Source: IPBES, 2019

Why biodiversity matters?

The Living Planet Report (2022) defines Biodiversity as “the variety of life and interactions between living things at all levels on land, in water and in the sea, and air” (WWF 2022, pg.17). Food, medicines, energy and fibers, are just some of the key services provided by terrestrial, freshwater and marine ecosystems. These ecosystems also provide for physical and psychological experiences, learning and inspiration, while supporting identities and a sense of place. Everything that enables us to live comes from nature (Ibidem).

Over the last 50 years, we have lost 1-2.5% of birds, mammals, amphibians, reptiles and fish, and about one million plants and animal species are at risk of extinction (WWF, 2022). Unsustainable use of land and sea resources, climate change, pollution and invasive alien species are the main drivers of biodiversity loss. In particular, land use change accounts for -25% of biodiversity loss and it is estimated that 32% of the world’s terrestrial area has been affected by it (Winkler et al., 2021). These are exacerbated by indirect drivers of biodiversity depletion, such as overpopulation, unsustainable demand for energy, food, and other materials, use of inefficient technologies, different modalities of managing natural resources, conflicts and epidemics (Ibidem)

What are biodiversity credits?

Biodiversity Credits are an economic instrument that can be used to finance projects and activities that produce positive and measurable goals for biodiversity (e.g., reintroduction of endangered species, ecosystem restoration and habitat protection, etc.) through the creation and sale of biodiversity units (WEF, 2022). As such, they can be defined as Payment for Ecosystem Services.

Biodiversity credits can help the public and private sector to realize an economic system that generates positive outcomes for the environment, but only if the following conditions apply (WEF, 2022):

- Transparent governance is in place;

- Indigenous people and local communities are involved in the project;

- There is clarity of additionality, robust measuring, reporting and verification (MRV) and solutions to address double counting;

- Permanence and unintended outcomes leaked to nearby geographies are considered to ensure success.

Biodiversity offsets vs biodiversity credits

While biodiversity offsets are mandatory costs that a company bears to compensate for any negative impacts on specific local ecosystems; biodiversity credits allow companies – on a voluntary basis – to invest in projects focused on biodiversity conservation and restoration, generating positive impacts way more meaningful than simply compensating for any biodiversity loss.

Biodiversity offsets and credits may indeed have a similar design. What sets them apart is the purpose for which they are purchased. Biodiversity credits are meant to be an investment for biodiversity conservation and restoration, whereas biodiversity offsets are a compensation for damages done to the environment. Moreover, we get to biodiversity offsets once the mitigation hierarchy has been applied to compensate for the residual impacts that couldn’t be avoided, mitigated or restored.

Overall, in our opinion, biodiversity credits should be part of a company’s nature positive journey.

Business case for biodiversity credits

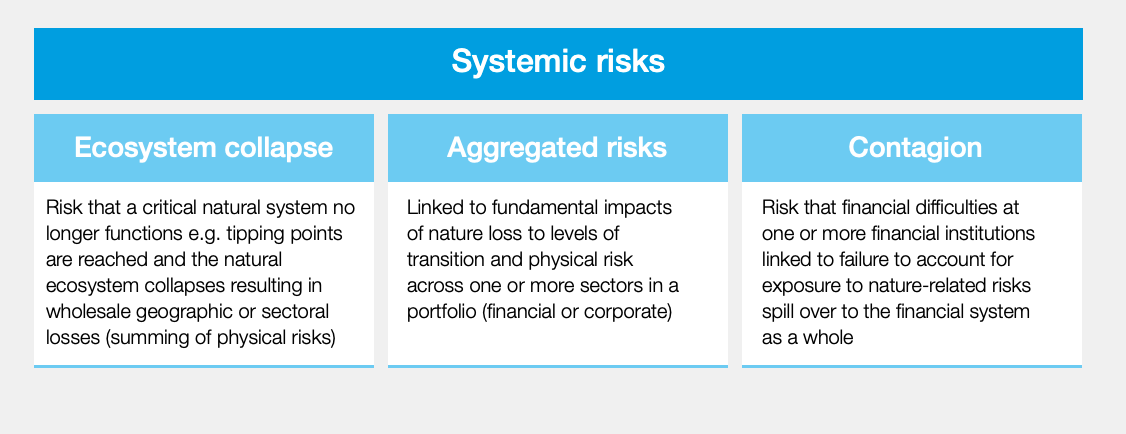

Biodiversity presents both risks and opportunities for businesses. Financial risks are not only limited to supply chains and commercial operations, but also include broad systemic risks associated with the decline and degradation of nature (WEF, 2022). Moving from a business-as-usual path to an economic model that has a positive impact on nature can create over $10.1 trillion in business opportunities (WEF, 2022). By mitigating the systemic risks associated with the decline and degradation of nature, biodiversity credits represent not only an excellent business opportunity, but they are also an innovative tool for financing actions aimed at the conservation, protection, and restoration of biodiversity, while also tackling climate and water targets.

Types of systemic risks associated with the decline and degradation of nature. Source: World Economic Forum, 2022

Biodiversity credits case studies

Globally, several initiatives are underway to design biodiversity credits and test the voluntary market for these credits. In this section we present three case studies.

- Italy: “BIOCLIMA”

In 2022, Lombardy Region, together with Cariplo Foundation and Etifor, has set up a public-private initiative to support investment in protected areas in Lombardy region. The mechanism foresees the involvement of private companies through the economic valuation of the ecosystem services (among which biodiversity) generated by local certified protected forest areas. Therefore, management bodies that wish to apply to the public fund “BioClima” must present at least 30% of private financing, coming from private companies aiming to take advantage of positive impacts of responsible forest management practices. Until now, 5.6 millions € were raised for conservation through this system.

- New Zealand: “Sustainable Development Unit”

In July 2022, New Zealand launched its new Ekos-facilitated biodiversity credits product with financial support from the Waikato Trust, the Wel Energy Trust and the D.V. Bryant Trust. These credits are called ‘Sustainable Development Units’ purchased from a supply chain company, Profile Group Limited. They fund the conservation management of 83 hectares at Sanctuary Mountain Maungatautari. Bio Credits are not offsets and have been issued to achieve short-term biodiversity outcomes.

- Colombia: “Voluntary Credits for Biodiversity“

Colombia introduced its new biodiversity credits last May 2022 created by ClimateTrade and Terrasos. These biocredits are called “voluntary biodiversity credits” (VBC) issued for the first time by the Bosque de Niebla-El Globo Habitat Bank. Each VBC, priced at $30, corresponds to 30 years of conservation and/or restoration of 10 square meters of the Bosque de Niebla forest, which is a rainforest that is home to many endangered species.